Insurance Regulatory and Development Authority of India has revised the premium rates of Motor Third Party insurance

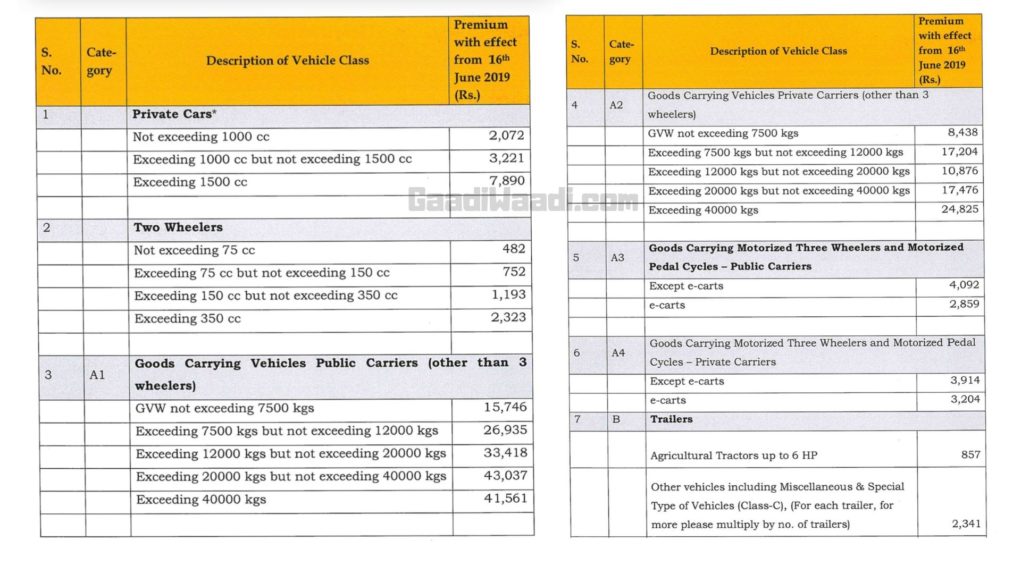

Insurance Regulatory and Development Authority of India has revised the premium rates of Motor Third Party insurance for the current fiscal year. The new proposed rates will come into effect from June 16, 2019. As per the revised premium rates, cars below 1000cc will now have to pay Rs 2,072 from the Rs 1,850.

For cars exceeding 1000cc but not exceeding 1500cc, the premium price is hiked from Rs 2,863 to Rs 3,221. However, the premium for cars exceeding 1500cc remains unchanged at Rs 7,890.

The highest percent of the increase of more than 21% can be noticed in the two-wheeler category falling between the range of 150cc and 350cc. The premium for vehicles falling under this category has been raised by Rs 208, from Rs 985 to Rs 1,193.

For two-wheelers falling between 75cc and 150cc, consumers will have to pay Rs 32 extra. The premium for bikes exceeding 350cc remains the same at Rs 2,323. The hike in premium prices has also been proposed for buses, trucks, taxis, and tractors.

The IRDAI has also introduced two new categories this year electric vehicles and a quadri-cycle. The premium rates for electric vehicles have been introduced on the basis of motor power at 17%. It is kept lower than the traditional vehicles to boost the presence of electric vehicles in the Indian market.

The premium price for electric cars not exceeding 30 kW is Rs 1,761. Buyers of electric cars exceeding 30 kW but not exceeding 65 kW have to pay Rs 2,738 and for car exceeding 65 Kw, the premium price is set at Rs 6,707.